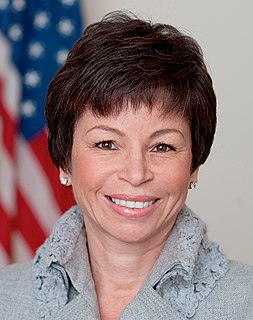

A Quote by Lori Lightfoot

As I examine progressive revenue options, I want to make sure wealthy individuals and businesses pay their fair share, that we reduce the burden on low-income and middle-class families, and not drive businesses from Chicago or create a disincentive for businesses to invest in our city.

Related Quotes

What we need to do together is to put in place the kind of - foster the kind of environment where businesses of all sizes - small, medium or large - want to invest, want to do the innovative things that our businesses here in America are known for doing, want to grow our economy and want to create the kind of jobs that will bring - reduce that unemployment rate.

In the absence of sound oversight,responsible businesses are forced to compete against unscrupulous and underhanded businesses, who are unencumbered by any restrictions on activities that might harm the environment, or take advantage of middle-class families, or threaten to bring down the entire financial system.

In the absence of sound oversight, responsible businesses are forced to compete against unscrupulous and underhanded businesses, who are unencumbered by any restrictions on activities that might harm the environment, or take advantage of middle-class families, or threaten to bring down the entire financial system.

When the government takes more money out of the pockets of middle class Americans, entrepreneurs, and businesses, it lessens the available cash flow for people to spend on goods and services, less money to start businesses, and less money for businesses to expand - i.e. creating new jobs and hiring people.

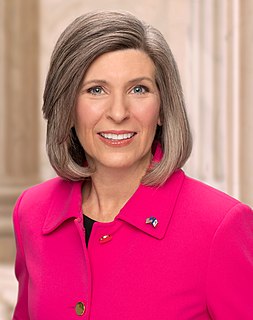

We're going to have to invest in the American people again, in tax cuts for the middle class, in health care for all Americans, and college for every young person who wants to go. In businesses that can create the new energy economy of the future. In policies that will lift wages and will grow our middle class. These are the policies I have fought for my entire career.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.