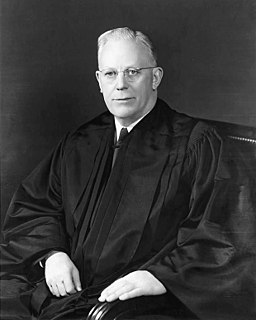

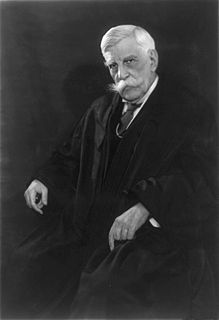

A Quote by Louis D. Brandeis

The tax-exempt privilege is a feature always reflected in the market price of [municipal] bonds. The investor pays for it.

Related Quotes

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

The individual investor should act consistently as an investor and not as a speculator. This means ... that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money's worth for his purchase.

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

We are convinced that the intelligent investor can derive satisfactory results from pricing of either type (market timing or fundamental analysis via price). We are equally sure that if he places his emphasis on timing, in the sense of forecasting, he will end up as a speculator and with a speculator's financial results." And "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.