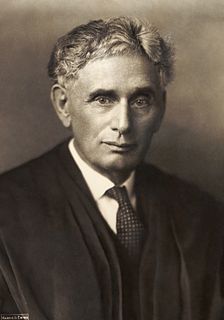

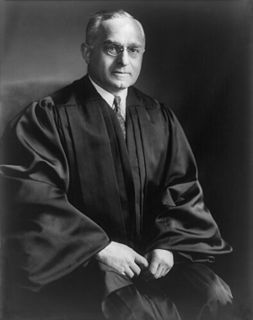

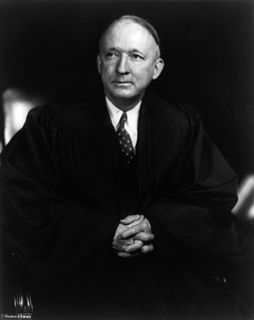

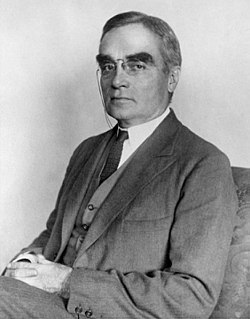

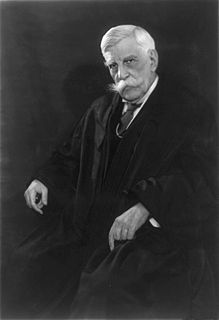

A Quote by Louis D. Brandeis

Related Quotes

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.

For all your long-term investments, such as retirement accounts that you won't touch for at least ten years, you need a mix of stocks and bonds. Stocks offer the best shot at inflation-beating gains. But stocks don't always go up. That's where bonds come into play: They have less upside potential, but they also do not pack the same risk.

In re-reading 'Presumed Innocent,' the one thing that struck me - and I re-read the book four different times in writing 'Innocent,' interested in different things each time - but I did think there were a couple of extra loops in the plot that I probably didn't need. The other thing that sort of amazed me was how discursive the book was.