A Quote by Louis O. Kelso

No Keynesian has ever proposed a measure designed to make the individual more productive; for that would require institutional means for enabling him to acquire ownership of the nonhuman factor of production: capital.

Related Quotes

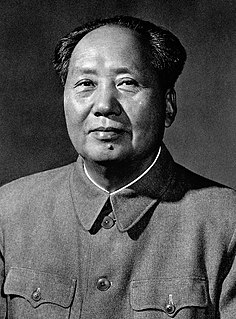

Socialist revolution aims at liberating the productive forces. The changeover from individual to socialist, collective ownership in agriculture and handicrafts and from capitalist to socialist ownership in private industry and commerce is bound to bring about a tremendous liberation of the productive forces. Thus, the social conditions are being created for a tremendous expansion of industrial and agricultural production.

Rather than providing him with economic opportunity, the Act of that name seems designed to make the poor man do penance all his life for the sin of being born into a non-capital-owning family... One searches it in vain for measure designed to provide economic opportunity to the capital owner. But nobody proposes to educate, train, or rehabilitate either him or his children, even when their "unemployment" is notorious.

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

Throughout the industrial era, economists considered manufactured capital - money, factories, etc. - the principal factor in industrial production, and perceived natural capital as a marginal contributor. The exclusion of natural capital from balance sheets was an understandable omission. There was so much of it, it didn't seem worth counting.

Competition always tends to bring about the most economical and efficient method of production. Those who are most successful in this competition will acquire more capital to increase their production still further; those who are least successful will be forced out of the field. So capitalist production tends constantly to be drawn into the hands of the most efficient.

It is preferable to regard labour, including, of course, the personal services of the entrepreneur, and his assistants, as the sole factor of production, operating in a given environment of technique, natural resources, capital equipment and effective demand. This is why we have been able to take labour as the sole physical unit which we require in our economic system, apart from units of money and of time.