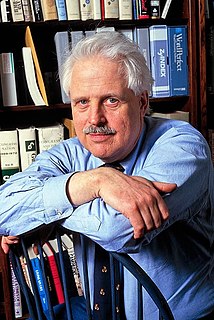

A Quote by Louis O. Kelso

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

Related Quotes

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

We preach free enterprise capitalism. We believe in it, we give our lives in war for it, but the closest most of us come to profiting from it are a few miserable shares of stock in a company that doesn't pay large enough dividends to keep a small mouse in cheese. The truth is, most of us are job serfs. At a time when invested capital returns 20 to 30 percent, we have no capital. We only have our wages and salaries, and a debt so high that something like 20c on every dollar we earn is spent to pay off what we owe.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Capital, and the question of who owns it and therefore reaps the benefit of its productiveness, is an extremely important issue that is complementary to the issue of full employment... I see these as twin pillars of our economy: Full employment of our labor resources and widespread ownership of our capital resources. Such twin pillars would go a long way in providing a firm underlying support for future economic growth that would be equitably shared.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

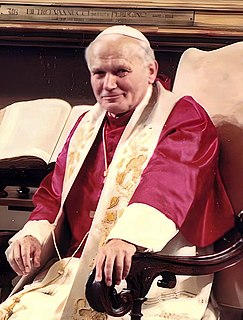

On the basis of his work each person is fully entitled to consider himself a part owner of the great workbench at which he is working with everyone else. A way toward that goal could be found by associating labor with the ownership of capital joint ownership of the means of work, sharing by the workers in the management and/or profits of businesses, so-called shareholding by labor, etc.

As more and more Americans own shares of stock, more and more Americans understand that taxing businesses is taxing them. Regulating businesses is taxing them. They ought to be thinking long-term about their ownership, not just their income, and that they should pay taxes on capital, as well as taxes on labor.