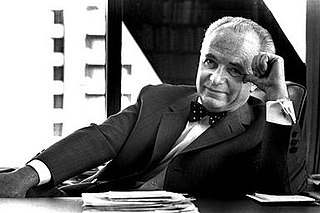

A Quote by Louis O. Kelso

If capital produces most of the economy's wealth and income is distributed on the basis of productive input, the individual can hardly reach his goal - an affluent level of income - solely by means of his labor.

Related Quotes

On the basis of his work each person is fully entitled to consider himself a part owner of the great workbench at which he is working with everyone else. A way toward that goal could be found by associating labor with the ownership of capital joint ownership of the means of work, sharing by the workers in the management and/or profits of businesses, so-called shareholding by labor, etc.

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

We got rich by violating one of the central tenets of economics: thou shall not sell off your capital and call it income. And yet over the past 40 years we have clear-cut the forests, fished rivers and oceans to the brink of extinction and siphoned oil from the earth as if it possessed an infinite supply. We've sold off our planet's natural capital and called it income. And now the earth, like the economy, is stripped.