A Quote by Louis V. Gerstner, Jr.

The value that some analysts put on revenue vs. what they put on profit is out of whack. If you can grow real cash earnings, that's 80% of what you ought to do, and the revenue component is 20%.

Related Quotes

I have endeavoured to show that the ability to pay taxes depends, not on the gross money value of the mass of commodities, nor on the net money value of the revenue of capitalists and landlords, but on the money value of each man's revenue compared to the money value of the commodities which he usually consumes.

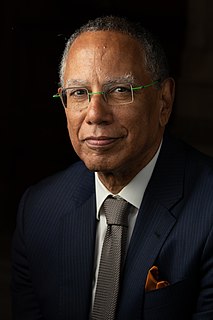

I also don't think all of the revenue will come from digital subscriptions. We have in the New York Times a mix of revenue sources and it will continue to be a mix for quite a while. What makes me more nervous is that we built this newsroom on a really high profit margin that has eroded significantly over the last years. I'm nervous that we won't continue to have the profit margins that allow us to have a big, robust newsroom.

Today, National Geographic has a membership side with a magazine and some television side, and they generate about a billion dollars in revenue, and they're profitable. And so at the end of the year they have some bottom line profit which they can then reinvest, because they're running it as a not-for-profit in charitable endeavors.

I came up with this idea to create an app. And the premise of the app is this: every problem in the bar business goes away when there's sales. You increase revenue and you solve every problem. It's when the revenues are low that [the business] doesn't work. So I wanted to put together an app that focused on top-line revenue, guest experience, and business management in a more organized way.

Business people do two things with their time fundamentally. The first is that they try to create sales, right? Revenue, key to business. But the other thing they devote their time to equally is cost containment. That is to say, how to not create jobs. Because the fewer jobs you can create for the revenue you create, the more profit you make.