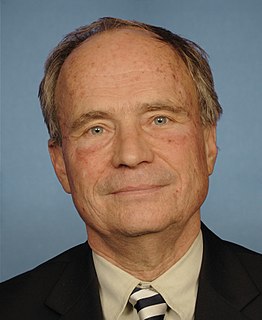

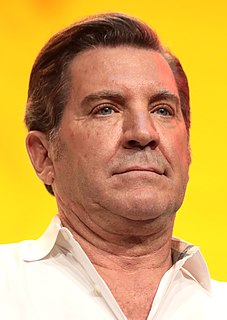

A Quote by Lucas Papademos

Greece could default on its debts and even exit currency bloc if it cannot deliver reforms.

Related Quotes

The best companies with the strongest credit ratings borrow like the United States: on a non-prioritized basis. This means that in the event of a default, all of their debts are of equal priority because lenders and creditors believe default is highly unlikely. And they spend considerable effort maintaining this status.

Greeks have to know that they are not alone ... Those who are fighting for the survivor of Greece inside the Euro area are deeply harmed by the impression floating around in the Greek public opinion that Greece is a victim. Greece is a member of the EU and the euro. I want Greece to be a constructive member of the Union because the EU is also benefiting from Greece.