A Quote by Lucy Powell

Surely, the best and most effective measure is to get the economy moving and shorten the period of recession or slowdown. That's the rationale for Gordon Brown's 'fiscal stimulus' and it sounds like a good one to me.

Related Quotes

Aggregate aid is to the Ethiopian economy what Obama's fiscal stimulus was to the American economy: minus these injections, both economies would suffer catastrophically. The theatrical blustering of the Ethiopian government notwithstanding, donor countries have a make-or-break power over the Ethiopia's prosperity.

The median family income in the U.S. is lower than it was a quarter-century ago, and if people don't have income, they can't consume, and you can't have a strong economy. There's significant risk - actually it's no longer a risk - a significant likelihood of a marked slowdown not only in China, but also in a lot of other countries like Brazil, which is in recession. All of the other countries that depend on commodities, including Canada, are facing difficulties. So it's hard to see a story of a strong U.S. economy.

One of the things I think is very likely is that with the prospects of robust fiscal stimulus in response to voters mad as hell, the Fed is going to be in there with helicopter money. In other words, they're going to be buying whatever the Treasury issues. They're not going to, in effect, advocate strong fiscal stimulus and then not finance it. And that's helicopter money.

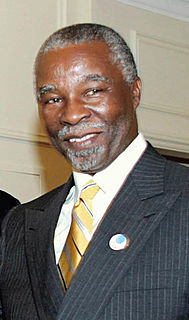

When I was in government, the South African economy was growing at 4.5% - 5%. But then came the global financial crisis of 2008/2009, and so the global economy shrunk. That hit South Africa very hard, because then the export markets shrunk, and that includes China, which has become one of the main trade partners with South Africa. Also, the slowdown in the Chinese economy affected South Africa. The result was that during that whole period, South Africa lost something like a million jobs because of external factors.