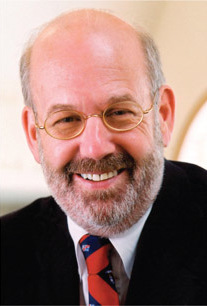

A Quote by Ludwig von Mises

The gold standard did not collapse. Governments abolished it in order to pave the way for inflation. The whole grim apparatus of oppression and coercion, policemen, customs guards, penal courts, prisons, in some countries even executioners, had to be put into action in order to destroy the gold standard.

Related Quotes

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

The problem right now is that central banks have not normalized their balance sheet since 2009. They're trying, but it's not even close. If we had another crisis tomorrow, and you had to do QE4 and QE5, how could you do that when you're already at $4 trillion? They might have to turn to the IMF or SDR or to Gold. Then, if you go back to the gold standard, you have to get the price right. People say there's not enough gold to support a gold standard. That's nonsense. There's always enough gold, it's just a question of price.

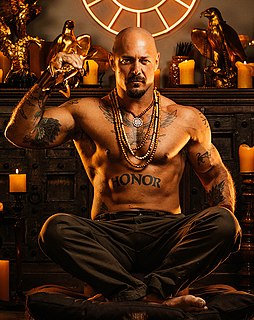

Violence is the gold standard, the reserve that guarantees order. In actuality, it is better than a gold standard, because violence has universal value. Violence transcends the quirks of philosophy, religion, technology, and culture. () It's time to quit worrying and learn to love the battle axe. History teaches us that if we don't, someone else will.

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.

Monetary reform, if it is to be genuine and successful, must sever money and banking from politics. That's why a modern gold standard must have: no central bank; no fixed rations between gold and silver; no bail-outs; no suspension of gold payments or other bank frauds; no monetization of debt; and no inflation of the money supply, all of which have proved so disastrous in the past.

The obsession with gold, actually and politically, occurs among those who regard economics as a branch of morality. Gold is solid, gold is durable, gold is rare, gold is even (in certain very peculiar circumstances) convertible. To believe in thrift, solidity and soundness is to believe in some way in the properties of gold.