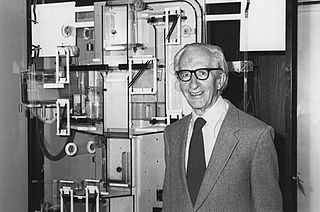

A Quote by Ludwig von Mises

Economic theory has demonstrated in an irrefutable way that a prosperity created by an expansionist monetary and credit policy is illusory and must end in a slump, an economic crisis.

Related Quotes

Library of the Works of Ludwig von Mises”. Here is an article he wrote in 1951, some two years after his magnum opus Human Action appeared, where is lays out his case in a more popular form. The money sentences are “Economic theory has demonstrated in an irrefutable way that a prosperity created by an expansionist monetary and credit policy is illusory and must end in a slump, an economic crisis. It has happened again and again in the past, and it will happen in the future, too.

From the Great Depression, to the stagflation of the seventies, to the current economic crisis caused by the housing bubble, every economic downturn suffered by this country over the past century can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial 'boom' followed by a recession or depression when the Fed-created bubble bursts.

Now it is unambiguously clear that trickle-down economics does not work. But what does that mean? That means we have to structure our economic policies to make sure that we have shared prosperity. And you don't do that by giving a tax cut to the big winners and raising taxes on those who have not done very well. Your economic policy has to respond to the way our economic system has been working.

The theory of economic shock therapy relies in part on the roleof expectations on feeding an inflationary process. Reining in inflation requires not only changing monetary policy but also changing the behavior of consumers, employers and workers. The role of a sudden, jarring policy shift is that it quickly alters expectations, signaling to the public that the rules of the game have changed dramatically - prices will not keep rising, nor will wages.

In his first year in office, President Obama pulled us back from the brink of the greatest economic crisis since the Great Depression and worked to lay a new foundation for economic growth. The president identified three key strategies to build that lasting prosperity: innovation, investment, and education.