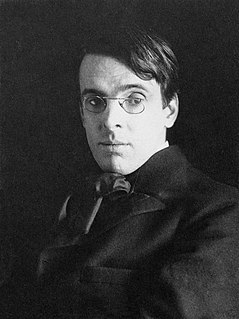

A Quote by Ludwig von Mises

Library of the Works of Ludwig von Mises”. Here is an article he wrote in 1951, some two years after his magnum opus Human Action appeared, where is lays out his case in a more popular form. The money sentences are “Economic theory has demonstrated in an irrefutable way that a prosperity created by an expansionist monetary and credit policy is illusory and must end in a slump, an economic crisis. It has happened again and again in the past, and it will happen in the future, too.

Quote Topics

Action

After

Again

Again And Again

Appeared

Article

Case

Created

Credit

Crisis

Economic

Economic Crisis

Economic Theory

End

Form

Future

Happen

Happened

His

Human

Illusory

In The Past

Lays

Library

Monetary

Money

More

Must

Out

Past

Policy

Popular

Prosperity

Sentences

Slump

Some

Theory

Too

Two

Two Years

Von

Von Mises

Way

Will

Works

Wrote

Years

Related Quotes

When man has mastered money he shall have mastered not only his economic problem of prosperity but also his political problem, for he will see that money has no place in state functions, and, the money power being entirely in his own hands, he will easily master the state and clearly define its services. Thus money must be seen as the means of mastery of all economic and political problems. Until we have mastered money we shall not master any of our problems. Not money, but a false money system, is the root of all evil.

From the Great Depression, to the stagflation of the seventies, to the current economic crisis caused by the housing bubble, every economic downturn suffered by this country over the past century can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial 'boom' followed by a recession or depression when the Fed-created bubble bursts.

Trump's victory clearly appears to stem from a sense of economic powerlessness, or a fear of losing power, among his supporters. To them, his simple slogan, 'Make America great again,' sounds like 'Make You great again': economic power will be given to the multitudes without taking anything away from the already successful.

We all to some extent meet again and again the same people and certainly in some cases form a kind of family of two or three or more persons who come together life after life until all passionate relations are exhausted, the child of one life the husband, wife, brother, sister of the next. Sometimes, however, a single relationship will repeat itself, turning its revolving wheel again and again.

The Federal Reserve is the overlord of the money supply. If these two are not steering in the same direction, they can either neutralize each other or have the economy lurching in all directions. This is not a rational system for setting economic policy. It has given us trouble in the past, as the text will establish, and will inevitably in the future.

There will come a moment when the most urgent threats posed by the credit crisis have eased and the larger task before us will be to chart a direction for the economic steps ahead. This will be a dangerous moment. Behind the debates over future policy is a debate over history-a debate over the causes of our current situation. The battle for the past will determine the battle for the present. So it's crucial to get the history straight.

Shaw does not merely decorate a proposition, but makes his way from point to point through new and difficult territory. This explains why Shaw must either be taken whole or left alone. He must be disassembled and put together again with nothing left out, under pain of incomprehension; for his politics, his art, and his religion - to say nothing of the shape of his sentences - are unique expressions of this enormously enlarged and yet concentrated consciousness.