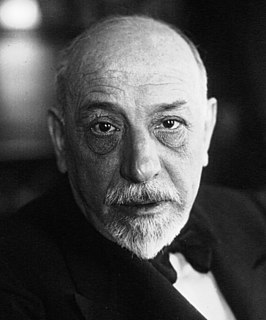

A Quote by Luigi Pirandello

Life is little more than a loan shark: It exacts a very high rate of interest for the few pleasures it concedes

Related Quotes

Knowledge and productivity are like compound interest. The more you know, the more you learn; the more you learn, the more you can do; the more you can do, the more the opportunity. I don`t want to give you a rate, but it is a very high rate. Given two people with exactly the same ability, the one person who manages day in and day out to get in one more hour of thinking will be tremendously more productive over a lifetime.

When I look back on my life, it seems nearly everything of interest happened in little more than one decade - dramas, tragedies, major events, pleasures, my close friendships with artists and political figures, the lovely places where I lived in England and New York, the trips to Europe, visits at the White House.

Imagine you have six loans, small to huge. People want to close loans and because of that, they try to pay off the small loans, but that's not the right strategy. The right strategy, of course, is to pay the loan with the highest interest rate. People make this mistake and it costs them lots and lots of money, it's a very expensive mistake because interest rates accumulate and become very, very expensive very quickly.