A Quote by Lysander Spooner

The fact is that the government, like a highwayman, says to a man: Your money, or your life. And many, if not most, taxes are paid under the compulsion of that threat.

Related Quotes

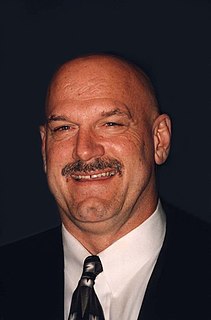

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.

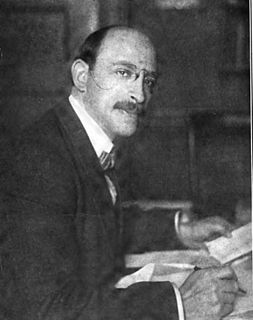

Income and inheritance taxes imply the denial of private property, and in that are different in principle from all other taxes. The government says to the citizen: “Your earnings are not exclusively your own; we have a claim on them, and our claim precedes yours; we will allow you to keep some of it, because we recognize your need, not your right; but whatever we grant you for yourself is for us to decide.

All taxpayers feel a tremendous sense of frustration as they see many tens of billions of dollars of bonuses paid to the same mega banks that were on the brink of bankruptcy and were only saved by massive government rescue money and support. We are not satisfied by the fact that many of them have paid the money back, nor should we be.

It is important to remember that government interference always means either violent action or the threat of such action. The funds that a government spends for whatever purposes are levied by taxation. And taxes are paid because the taxpayers are afraid of offering resistance to the tax gatherers. They know that any disobedience or resistance is hopeless. As long as this is the state of affairs, the government is able to collect the money that it wants to spend.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

The theory of government I was taught says that government provides benefits, primarily security, to the entire population. In return we pay taxes. But lately the government has been a distributor of special privileges, taking money from some and giving it to others. America is now about evenly split between those who pay income taxes and those who consume them.

The highwayman takes solely upon himself the responsibility, danger, and crime of his own act. He does not pretend that he has any rightful claim to your money, or that he intends to use it for your own benefit ... Furthermore, having taken your money, he leaves you, as you wish him to do ... He does not keep "protecting" you by commanding you to bow down and serve him; by requiring you to do this, and forbidding you to do that.

If I were a candidate for running, I'd say, "Look at what the economy has done." It's strong. We've created a lot of jobs. I'd be telling people that the Democrats will raise your taxes. I'd be reminding people that tax cuts have worked in terms of stimulating the economy. I'd be reminding people there's a philosophical difference between those who want to raise taxes and have the government spend the money, and those of us who say, "You get to spend the money the way you want to see fit. It's your money."