A Quote by Madalyn Murray O'Hair

I'd make an educated guess that 20 to 25 percent of the taxable property in the U.S. is Church-owned.In a recent book, Church Wealth and Business Income, it was estimated that this property -all of it tax-exempt -is worth upwards of 80 billion dollars. I know that's a fantastic, unbelievable figure, but there's every reason to believe that it's on the conservative side; and this amount is increasing yearly at a geometric rate.

Related Quotes

The divorce between Church and State ought to be absolute. It ought to be so absolute that no Church property anywhere, in any state or in the nation, should be exempt from equal taxation; for if you exempt the property of any church organization, to that extent you impose a tax upon the whole community.

On a nationwide basis, I would guess that the various churches would have to pay annually an amount at least equal to the national debt. But it's impossible for me to make an exact estimate, because the churches hide their wealth in every way they can - deliberate falsification as to the value of property, registering it under phony names in order to obscure the fact that the Church owns the property.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

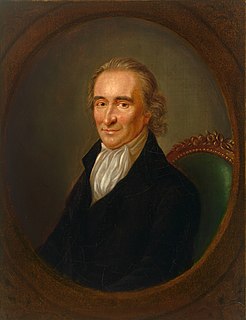

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

Legislators cannot invent too many devices for subdividing property... Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise. Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

There's a separation of church and state. If you want the perks that churches have traditionally received, then abide by the rules. If you're going to be involved in the political process, even in soft ways, then surrender the privileges. Let ministers pay income tax on all of their income. Let churches pay income tax, let them pay property taxes. They can't have it both ways. You can't pat the politicians on the back, break the rules, and then get all these perks.

Economists often talk about the 80/20 Principle, which is the idea that in any situation roughly 80 percent of the “work” will be done by 20 percent of the participants. In most societies, 20 percent of criminals commit 80 percent of crimes. Twenty percent of motorists cause 80 percent of all accidents. Twenty percent of beer drinkers drink 80 percent of all beer. When it comes to epidemics, though, this disproportionality becomes even more extreme: a tiny percentage of people do the majority of the work.

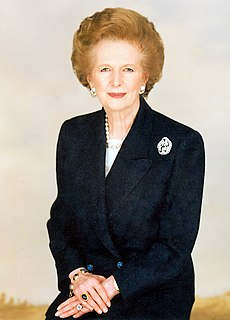

We very much hope that as we get growth that we can reduce the burden of taxation, that we can reduce income tax and increase the amount of genuine free enterprise and business enterprise... This is going... toward the restoration of the personal responsibility, the independence, with every man a property owner, every man a capitalist.

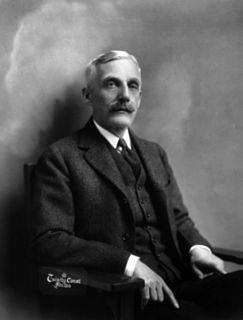

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.