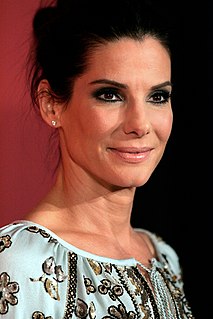

A Quote by Maggie Cheung

I did 75 films. I didn't take a break; I didn't spend my money. I have my savings, so when you're not working for money anymore, then you should find things that are meaningful and not just be like, 'OK, that's another day gone.'

Related Quotes

With money we really fool ourselves. We are our biggest enemies with money and there are some things we can do about it. Automatic deductions are a wonderful thing. But ideally, you should wait until the end of the month, you can see how much extra money you had, and you should put that in your savings account. We don't do that too well, and if we did that, we would never save. So, what we do, is we take money out of our pocket into the saving account at the beginning of the month, take it outside of our control and as a consequence, we spend less and we save more.

For me, money is to use - it's only to use. So I never have money because I always spend. That's why in a way I protect myself in having houses. But if I had just cash or kept it in the bank, I'd spend it immediately. But not for stupid things. So I don't like to have money. I never have money in my pocket.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

Then there was communism's weak-tea sister, socialism. Socialists maintained that we shouldn't take all the money away from all the people since all the people don't have money. We should take all the money away from only the people who make money. Then, when we run out of that, we could take more money from the people who...hey, wait! Where'd you people go? What do you mean you're "tax exiles in Monaco?"

Under the old system - which is now so archaic that a lot of people can't remember it - if you wanted money you had to go to the bank and take the money out in cash form, and you couldn't take out money that you didn't have. But with the credit card you can spend money you don't have, and that is just so tempting.

Not having a schedule is OK if it's your PhD and you plan to spend 14 years on the thing, or if you're a programmer working on the next Duke Nukem and we'll ship when we're good and ready. But for almost any kind of real business, you just have to know how long things are going to take, because developing a product costs money.

At the beginning of a remodel, money is everything, but as you go along, it becomes secondary to the vision. You can't have the house looking like a glorious jewel and leave the cracked linoleum or the icky light fixture, so you spend and spend and spend. Then one day it suddenly occurs to you that all that play money you've been throwing around is real - and it's in someone else's bank account.

Is money money or isn't money money. Everybody who earns

it and spends it every day in order to live knows

that money is money, anybody who votes it to be

gathered in as taxes knows money is not money. That

is what makes everybody go crazy.... When you earn

money and spend money every day anybody can know the

difference between a million and three. But when you

vote money away there really is not any difference

between a million and three.