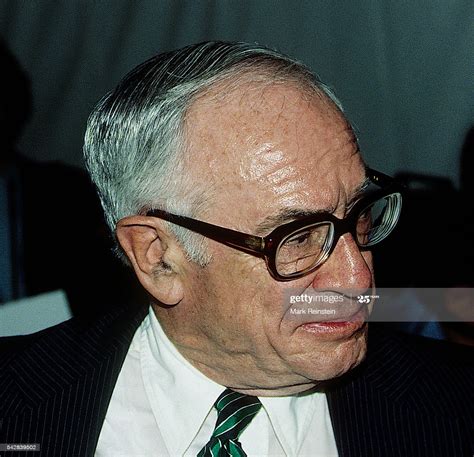

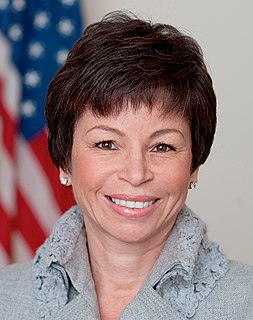

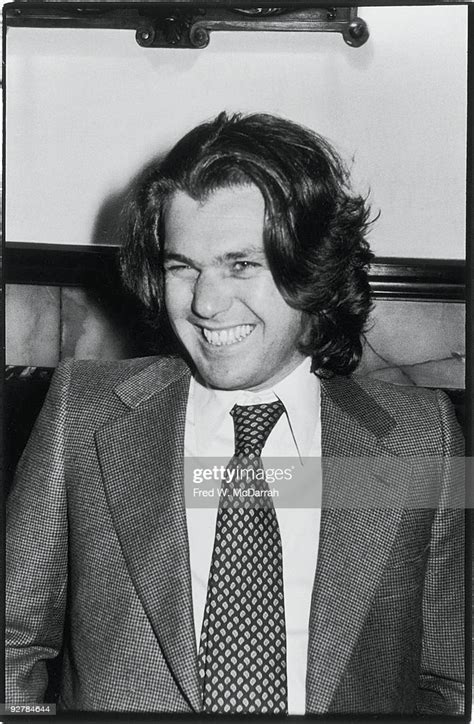

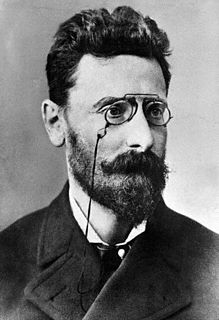

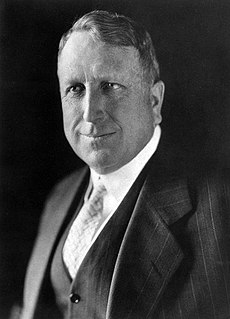

A Quote by Malcolm Forbes

It's much more profitable to sell investing advice than to follow it.

Related Quotes

American business at this point is really about developing an idea, making it profitable, selling it while it's profitable and then getting out or diversifying. It's just about sucking everything up. My idea was: Enjoy baking, sell your bread, people like it, sell more. Keep the bakery going because you're making good food and people are happy.