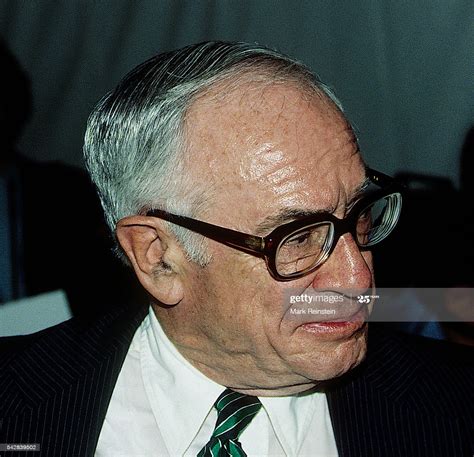

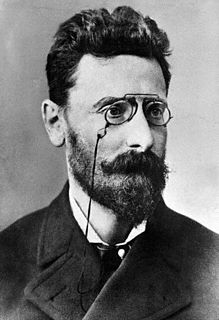

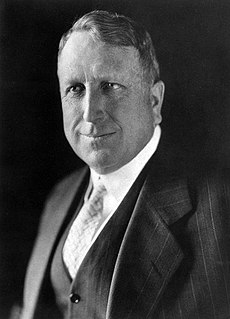

A Quote by Malcolm Forbes

SM is an abbreviation of both stock market and sadomasochism-- and there are those who think they are one and the same.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.