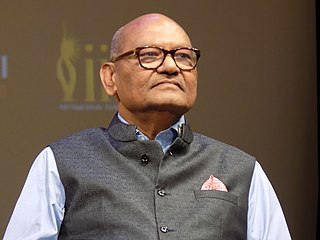

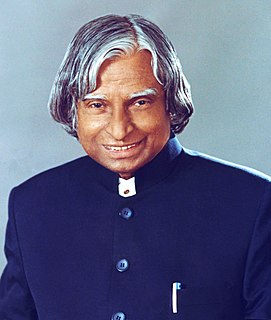

A Quote by Manmohan Singh

70 percent of India's imports of oil and oil products are imported from abroad. There is uncertainty about supply. There is uncertainty about prices. And that hurts India's development.

Related Quotes

This morning, prompted by increasing concerns about terrorism, oil prices reached a record high as the cost of a barrel of crude is a whopping $44.34. Wow, it seems shocking that a product of finite supply gets more expensive the more we use it. Now the terror alert means higher oil prices, which oddly enough means higher profits for oil companies giving them more money to give to politicians whose policies may favor the oil companies such as raising the terror alert level. As Simba once told us: "It's the circle of life."

There's a huge misconception that it's all about the oil, and the truth is there's actually not much oil left in Abyei. The misperception arose because when the peace agreement was signed in 2005, Abyei accounted for a quarter of Sudan's oil production. Since then, the Permanent Court of Arbitration in The Hague defined major oil fields to lie outside Abyei. They're in the north now, not even up for grabs, and they account for one percent of the oil in Sudan. The idea that it's "oil-rich Abyei" is out of date.

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

The oil industry is a stunning example of how science, technology, and mass production can divert an entire group of companies from their main task. ... No oil company gets as excited about the customers in its own backyard as about the oil in the Sahara Desert. ... But the truth is, it seems to me, that the industry begins with the needs of the customer for its products. From that primal position its definition moves steadily back stream to areas of progressively lesser importance until it finally comes to rest at the search for oil.