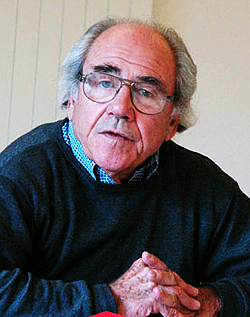

A Quote by Manuel Castells

As for the employees, the payment in stock options revives, somewhat ironically, the old anarchist ideology of self-management of the company, as they are co-owners, co-producers, and co-managers of the firm.

Related Quotes

The only beef Enron employees have with top management is that management did not inform employees of the collapse in time to allow them to get in on the swindle. If Enron executives had shouted, "Head for the hills!" the employees might have had time to sucker other Americans into buying wildly over-inflated Enron stock. Just because your boss is a criminal doesn't make you a hero.

Nothing in finance is more fatuous and harmful, in our opinion, than the firmly established attitude of common stock investors regarding questions of corporate management. That attitude is summed up in the phrase: "If you don't like the management, sell your stock." ... The public owners seem to have abdicated all claim to control over the paid superintendents of their property.

The modern joint stock firm is the outcome of innumerable decisions made by individual entrepreneurs, owners and managers. For these decision makers the choices among alternatives were limited and the outcomes uncertain, but almost always there were choices. Despite the variability of these individual decisions, taken cumulatively they produced clear patterns of institutional change

Common hedging techniques include shorting stocks, buying put options, writing call options, and various types of leverage and paired transactions. While I do reserve the right to use these tools if and when appropriate, my firm opinion is that the best hedge is buying an appropriately safe and cheap stock.

The CEO announces that the purpose of the firm is to improve the lives of the customers and the lives of the firm's stakeholders and the quality of the planet. The company will give fair compensation to all the stakeholders and the CEO will not earn more than 20 times the median income of his employees. He will want his employees to rate him, just as he also has to rate them.

The central problem of management is how spontaneous interaction of people within a firm, each possessing only bits of knowledge, can bring about the competitive success that could only be achieved by the deliberate direction of a senior management that possesses the combined knowledge of all employees and contractors

I am certain that Gadi Lesin's abilities and the experience he accumulated during his sixteen years in a variety of general management roles in Strauss Group in and outside of Israel will enable him, together with group management and all managers and employees of Strauss, to continue to take the group forward to further success.