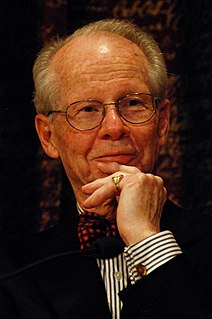

A Quote by Marc Faber

I believe that the market is slowly waking up to the fact that the Federal Reserve is a clueless organization. They have no idea what they're doing. And so the confidence level of investors is diminishing, in my view.

Related Quotes

"No one is doing what we're doing." This is a bummer of a lie because there are only two logical conclusions. First, no one else is doing this because there is no market for it. Second, the entrepreneur is so clueless that he can't even use Google to figure out he has competition. Suffice it to say that the lack of a market and cluelessness is not conducive to securing an investment. As a rule of thumb, if you have a good idea, five companies are going the same thing. If you have a great idea, fifteen companies are doing the same thing.

Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands. By having confidence in their own analysis and judgement, they respond to market forces not with blind emotion but with calculated reason. Successful investors, for example, demonstrate caution in frothy markets and steadfast conviction in panicky ones. Indeed, the very way an investor views the market and it’s price fluctuations is a key factor in his or her ultimate investment success or failure.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.