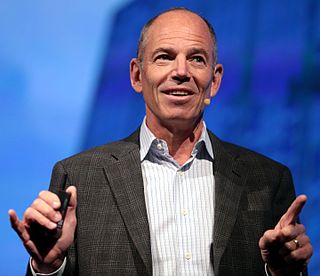

A Quote by Marc Randolph

In a two-sided market, focusing on the customer will increase a business's ability to extract value from the supply side.

Related Quotes

Your business should be defined, not in terms of the product or service you offer, but in terms of what customer need your product or service fulfills. While products come and go, basic needs and customer groups stay around, i.e., the need for communication, the need for transportation, etc. What market need do you supply?

Those with engineering skills will build tomorrow's genius computers. But those with the ability to create knowledge of any kind will be the ones who are best able to extract great value from them. The way to create value in the age of genius machines will be to compile and disseminate knowledge that other people will find useful.

If you think there is no action that you can perform

in your current circumstances that will increase the

supply of love in the world, you are believing a lie.

At the very least, you always have the option to offer

yourself kindness and understanding. That alone

can increase the supply of love in the world.

When everybody else is in a down market is focusing on what they're doing wrong, instead focus on what you should be doing differently, it may be that what you did in the past was perfectly right. It is possible to do all the right things in business and still have a business crisis because of what's happening in the external environment. And if you start focusing on mistakes only, you're going to miss opportunities.

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.

The business plan should address: "How will I get customers? How will I market the product or service? Who will I target?" The principles of a business plan are pretty much the same. But after page one to two, everything is unpredictable, because costs or competition will change and you don't know how things will be received by the market. You have to be able to continually adapt. Companies that fail to adapt will die. Others are brilliant at adapting.

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace.