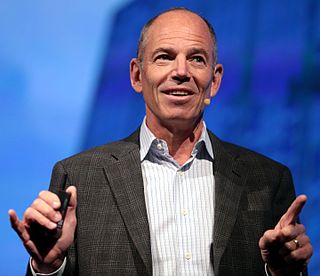

A Quote by Marc Randolph

My father was an investment banker, a stock broker.

Quote Topics

Related Quotes

A broker who discovers an undervalued stock does not advertise it until he has bought a large enough quantity without letting the price go up. When the brokers' connection with a stock becomes public knowledge, it is usually a sure sign of manipulation and that the broker is seeking to drive up the price.

My rather puritanical view is that any investment manager, whether operating as broker, investment counselor of a trust department, investment company, etc., should be willing to state unequivocally what he is going to attempt to accomplish and how he proposes to measure the extent to which he gets the job done.

Rather, risk is a perception in each investor's mind that results from analysis of the probability and amount of potential loss from an investment. If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky. But if the well is a gusher, the bond matures on schedule, and the stock rallies strongly, can we say they weren't risky when the investment after it is concluded than was known when it was made.

Unlike return, however, risk is no more quantifiable at the end of an investment that it was at its beginning. Risk simply cannot be described by a single number. Intuitively we understand that risk varies from investment to investment: a government bond is not as risky as the stock of a high-technology company. But investments do not provide information about their risks the way food packages provide nutritional data.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.