A Quote by Marco Rubio

Increasing access to federal student loans has been a bipartisan effort in Washington, one that I have supported. But it has created what many experts believe is a bubble in higher education, not unlike the housing bubble that preceded the financial crisis.

Related Quotes

Too-easy credit and millions of bad loans made during the U.S. housing bubble paved the way for the financial calamity and Great Recession that followed. Today, by contrast, credit is too tight. Mortgage loans are particularly hard to get, creating a problem for the housing market and the broader economy.

From the Great Depression, to the stagflation of the seventies, to the current economic crisis caused by the housing bubble, every economic downturn suffered by this country over the past century can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial 'boom' followed by a recession or depression when the Fed-created bubble bursts.

The higher amount you put into higher education, at the federal level particularly, the more the price of higher education rises. It's the dog that never catches its tail. You increase student loans, you increase grants, you increase Pell grants, Stafford loans, and what happens? They raise the price.

It is no exaggeration to say that rising inequality has driven many of the 99 percent into a financial ditch. It also helped spawn the housing bubble that gave us the financial crisis of 2008, the lingering effects of which have forced many OWS protesters to try to launch their careers in by far the most inhospitable labor market we've seen since the Great Depression. Even those recent graduates who manage to find jobs will suffer a lifelong penalty in reduced wages.

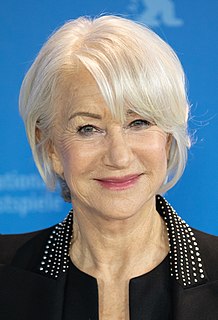

I've not won different awards - many, many times - so luckily I've practiced that whenever you are nominated for anything, you enter into this marvelous, fantabulous bubble called the bubble of nomination. The minute the envelope is opened and your name isn't called out, the bubble bursts. And no one calls you up the next day to say, 'So sorry you didn't win,' or 'You looked gorgeous - nothing. If you win, you get about another 24 hours in that lovely bubble and then - pop - you are slightly wet all over from the bubble and realize that you have to get on with real life.

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.