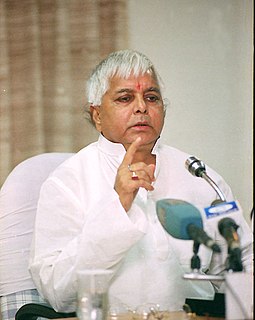

A Quote by Marek Belka

Should that worse scenario materialize, then most probably our propensity to increase interest rates will be weaker.

Related Quotes

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.