A Quote by Margaret Thatcher

Related Quotes

It’s hard to build models of inflation that don't lead to a multiverse. It’s not impossible, so I think there’s still certainly research that needs to be done. But most models of inflation do lead to a multiverse, and evidence for inflation will be pushing us in the direction of taking [the idea of a] multiverse seriously.

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

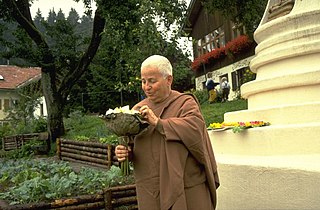

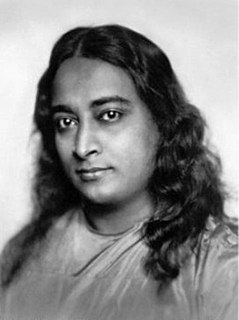

Suffering is our best teacher because it

hangs onto us and keeps us in its grip

until we have learnt that particular

lesson. Only then does suffering let go. If

we haven’t learnt our lesson, we can be

quite sure that the same lesson is going

to come again, because life is nothing but

an adult education class, If we don’t pass

in any of the subjects, we just have to sit

the examination again. Whatever lesson

we have missed, we will get it again. That

is why we find ourselves reacting to

similar situations in similar ways many

times.