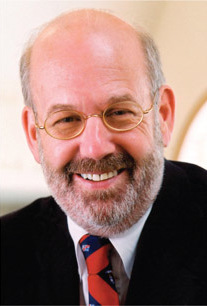

A Quote by Mark Cuban

In these times of the "Great Recession", we shouldn't be trying to shift the benefits of wealth behind some curtain. We should be celebrating and encouraging people to make as much money as they can. Profits equal tax money. While some people might find it distasteful to pay taxes, I don't. I find it patriotic.

Related Quotes

In these times of the 'Great Recession', we shouldn't be trying to shift the benefits of wealth behind some curtain. We should be celebrating and encouraging people to make as much money as they can. Profits equal tax money. While some people might find it distasteful to pay taxes, I don't. I find it patriotic.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

There's a lot of money in selling marijuana. If you can do it legally, that's good. Why should all the criminals make the money? This is what people are thinking. If it's happening, if it's going to be legal, let's tax it and regulate it, like we do with everything else and make some money off this. I think that's one reason why people are talking this a little more seriously.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

Then there was communism's weak-tea sister, socialism. Socialists maintained that we shouldn't take all the money away from all the people since all the people don't have money. We should take all the money away from only the people who make money. Then, when we run out of that, we could take more money from the people who...hey, wait! Where'd you people go? What do you mean you're "tax exiles in Monaco?"

There are times when a market such as housing, transportation or the stock or mortgage market keep rising and people with capital want to join in this growth. Soon the markets become overheated, partly because of the abundance of investment money and speculation. This is when the government should raise interest rates and increase the cost of borrowed money. Governments are shy about doing this because it could cause the very recession. Yet this is the best time to do this so that the inevitable recession never reaches the magnitude of the recent Great Recession.

Some people say I'm saying what they wanna say. Some people don't agree. Some people are outraged. Some people want to see what the album is about. To me, hip-hop's been dead for years. We all should know that, come on. With that being said, then, the object of the game now is to make money off of exploiting it. That's what it's all about - get this money. That's basically what I'm saying.

I guess I just use the word vibe in pretty much everyday context and every sentence I possibly can. Some people find it hilarious, some people find it cool, some people find it infuriating, but ultimately it's coming out of my mouth so as long as i I like the sound of it who cares too much what anyone else thinks?