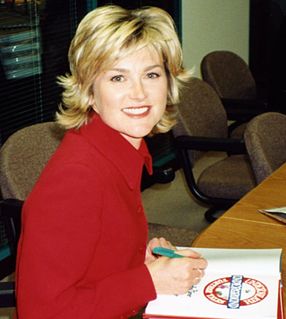

A Quote by Mark Cuban

Credit cards are the WORST investment that you can make.

Quote Topics

Related Quotes

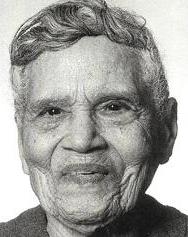

The world is a puzzling place today. All these banks sending us credit cards, with our names on them. Well, we didn't order any credit cards! We don't spend what we don't have. So we just cut them in half and throw them out, just as soon as we open them in the mail. Imagine a bank sending credit cards to two ladies over a hundred years old! What are those folks thinking?

Secured cards can be helpful credit rebuilding tools for two reasons. First, because of the collateral, you can get them at a time when you're not likely to be approved for nonsecured cards. And as long as you maintain an on-time payment history, they can help you start to build a recent credit history that's fairly pristine.

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.