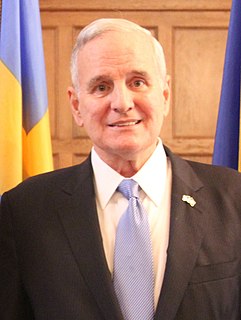

A Quote by Mark Dayton

The fine print in the President's Social Security proposal is that all present and future workers under age 55 will have their promised retirement benefits cut.

Related Quotes

You can look at history of these things, and Social Security wasn't devised to be a system that supported you for a 30-year retirement after a 25-year career... So there will be things that, you know, the retirement age has to be changed, maybe some of the benefits have to be affected, maybe some of the inflation adjustments have to be revised.

The President's policy proposal, known as 'chained CPI,' would re-calculate the cost of living for Social Security beneficiaries. That new number won't keep up with inflation on things like food and health care -- the basics that we need to live. In short, 'chained CPI' is just a fancy way to say 'cut benefits for seniors, the permanently disabled, and orphans.'

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.