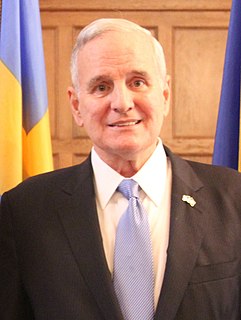

A Quote by Mark Dayton

Once again, the Republicans in the Senate have rejected an increase in the minimum wage. They support tax breaks for multi-millionaires, but they oppose helping the working poor to earn a decent income.

Related Quotes

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

Raising the minimum wage and lowering the barriers to union organization would carry a trade-off - higher unemployment. A better idea is to have the government subsidize low-wage employment. The earned-income tax credit for low-income workers - which has been the object of proposed cuts by both President Clinton and congressional Republicans - has been a positive step in this direction.

But can we please stop insisting that if low-wage workers earn a little bit more, unemployment will skyrocket and the economy will collapse? There is no evidence for it. The most insidious thing about trickle-down economics is not the claim that if the rich get richer, everyone is better off. It is the claim made by those who oppose any increase in the minimum wage that if the poor get richer, that will be bad for the economy. This is nonsense.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

I was on the committee that helped raise the minimum wage here in Seattle. I introduced a statewide bill to raise the minimum wage in Washington state my first year in the state senate, and I really believe that raising the federal minimum wage, while not the answer to everything, addresses a lot of the issues at the very bottom.

Especially for the young and the lowest-skilled, minimum wage becomes a toll that prevents many from entering the work force and gaining the skills that can make a low income or middle class worker a high income worker. This is so obvious that one wonders why liberals keep championing the minimum wage cause.