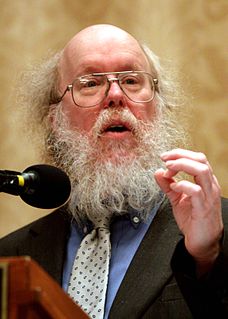

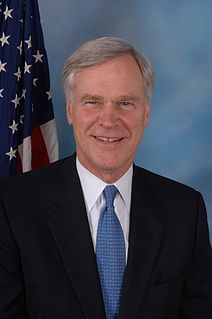

A Quote by Mark Meadows

The IRS isn't the only agency using taxpayer dollars for big bonuses.

Related Quotes

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

Much has already been learned about the arrogance of the IRS from the House investigations of the agency's targeting of conservatives. The revelations emerged despite strenuous efforts by Democrats in Washington and by the IRS itself to block inquiries and deny the existence of political targeting - targeting that the former head of the IRS Exempt Organizations Unit, Lois Lerner, eventually acknowledged and apologized for in May 2013.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

U.S. failures when it comes to the Gulf of Guinea are many: a failure to address the longstanding concerns of a government watchdog agency, a failure to effectively combat piracy despite an outlay of tens of millions of taxpayer dollars, and a failure to confront corrupt African leaders who enable piracy in the first place.