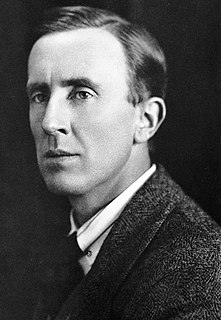

A Quote by Mark Twain

There is something fascinating about science. One gets such wholesale returns of conjecture out of such a trifling investment of fact.

Quote Topics

Related Quotes

In the space of one hundred and seventy-six years the Mississippi has shortened itself two hundred and forty-two miles. Therefore, in the Old Silurian Period the Mississippi River was upward of one million three hundred thousand miles long, seven hundred and forty-two years from now the Mississippi will be only a mile and three-quarters long. There is something fascinating about science. One gets such wholesome returns of conjecture out of such a trifling investment of fact.

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

If somebody asked for the first draft of something I'd written, it'd probably be pretty close to whatever got published. I get enjoyment out of writing, but I get absolutely no enjoyment out of rewriting, so I don't do much of it. The more you work on something, certainly, the better it gets. But there's also a pretty clear law of diminishing returns.

Textbook science is beautiful! Textbook science is comprehensible, unlike mere fascinating words that can never be truly beautiful. Elementary science textbooks describe simple theories, and simplicity is the core of scientific beauty. Fascinating words have no power, nor yet any meaning, without the math.

A new product, technology, or innovation - such as Bitcoin - has the potential to give rise both to frauds and high-risk investment opportunities. Potential investors can be easily enticed with the promise of high returns in a new investment space and also may be less skeptical when assessing something novel, new, and cutting-edge.