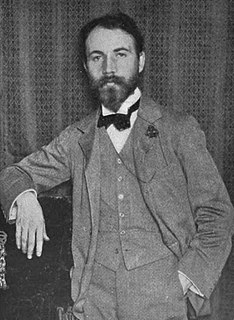

A Quote by Mark Twain

No church property is taxed and so the infidel and the atheist and the man without religion are taxed to make up the deficit.

Related Quotes

If all those magnificent cathedrals with their valuable lands in Boston, Philadelphia and New York were taxed as they should be, the taxes of women who hold property would be proportionately lightened....I cannot see any good reason why wealthy churches and a certain amount of property of the clergy should be exempt from taxation, while every poor widow in the land, struggling to feed, clothe, and educate a family of children, must be taxed on the narrow lot and humble home.

Though tax records are generally looked upon as a nuisance, the day may come when historians will realize that tax records tell the real story behind civilized life. How people were taxed, who was taxed, and what was taxed tell more about a society than anything else. Tax habits could be to civilization what sex habits are to personality. They are basic clues to the way a society behaves.

In real estate you can avoid ever having to pay a capital gains tax, decade after decade, century after century. When you sell a property and make a capital gain, you simply turn around and buy a new property. The gain is not taxed. It's called "preserving your capital investment" - which goes up and up in value with each transaction.

I believe in a wall between church and state so high that no one can climb over it. When religion controls government, political liberty dies; and when government controls religion, religious liberty perishes. Every American has the constitutional right not to be taxed or have his tax money expended for the establishment of religion. For too long the issue of government aid to church related organizations has been a divisive force in our society and in the Congress. It has erected communication barriers among our religions and fostered intolerance.