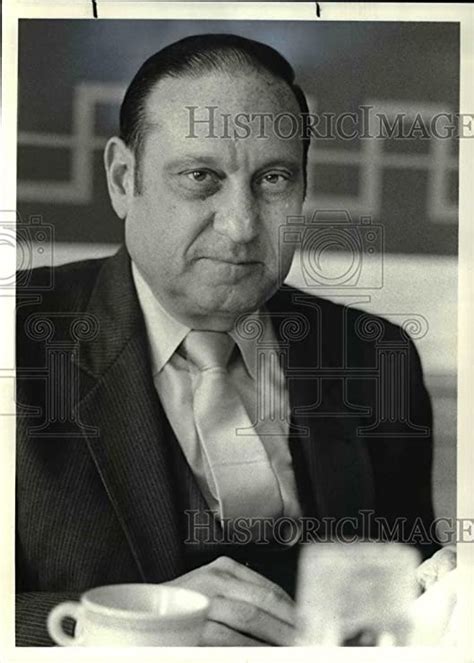

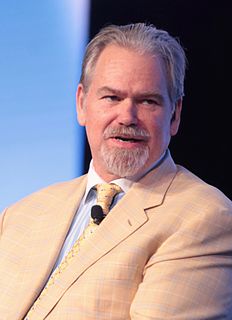

A Quote by Mark V. Hurd

For the most part, earnings and market value growth are a result of reduced expenses.

Related Quotes

In our view, though, investment students need only two well-taught courses-How to Value a Business, and How to Think about Market Prices. Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business who's earnings are virtually certain to be materially higher five, ten and twenty years from now.