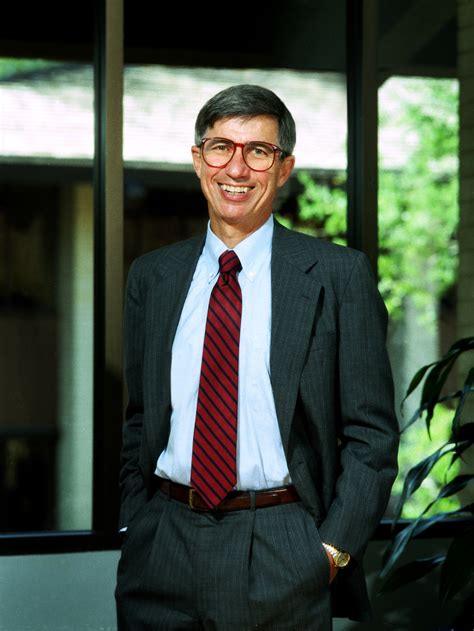

A Quote by Mark V. Hurd

It's counterproductive to lower my price, because I have to sell more units to make up for that lost revenue. Generating brand-new products can take a long time. Improving service is typically the quickest way that I can take market share. So aligning technology strategy to better service customers becomes an essential path to revenue growth.

Related Quotes

When I hear the president of the United States in a great little rhetorical flourish talk about the leavening hand of the government, everybody knows that leavening hand is attached to the long arm of the Internal Revenue Service. And no one mistakes the Internal Revenue Service with something called liberty.

The scale of revenue growth is unprecedented. If you look back over history, whether you're looking at the railway robber baron era or the 1920s or the '50s or the '70s, it used to take a long time for a company to get to the point where they had tens of millions of dollars of revenue. It was almost never an overnight phenomenon.

Because these firms listened to their customers, invested aggressively in new technologies that would provide their customers more and better products of the sort they wanted, and because they carefully studied market trends and systematically allocated investment capital to innovations that promised the best returns, they lost their positions of leadership.

Now, in economic crises times, the kind of things you're looking at is it's generally harder to get capital, revenue growth may be more, revenue lines may be unstable or growth may be less easy to predict that you're going to get to. And so what you do is you take a certain conservative approach of when, as all entrepreneurs should do, you plan for both good luck and bad luck, you put extra time on, "Okay, if I have bad luck, what do I do about that?"

When the functionality of a product or service overshoots what customers can use, it changes the way companies have to compete. When the product isn't yet good enough, the way you compete is by making better products. In order to make better products, the architecture of the product has to be interdependent and proprietary in character.

Service standards keep rising. As competitors render better and better service, customers become more demanding. Their expectations grow. When every company's service is shoddy, doing a few things well can earn you a reputation as the customer's savior. But when a competitor emerges from the pack as a service leader, you have to do a lot of things right. Suddenly achieving service leadership costs more and takes longer. It may even be impossible if the competition has too much of a head start. The longer you wait, the harder it is to produce outstanding service.

Occasionally we are asked whether it would make sense to modify our investment strategy to perform better in today's financial climate. Our answer, as you might guess, is: No! It would be easyfor us to capitulate to the runaway bull market in growth and technology stocks. And foolhardy. And irresponsible. And unconscionable. It is always easiest to run with the herd; at times, it can take a deep reservoir of courage and conviction to stand apart from it. Yet distancing yourself from the crowd is an essential component of long-term investment success.