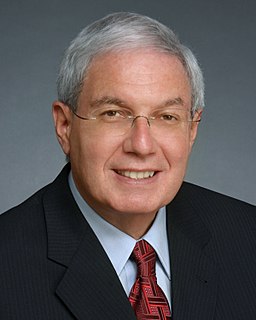

A Quote by Mark Zandi

The extension and expansion of the payroll tax holidays for workers would be number one on my list and key to avoiding recession.

Related Quotes

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.

If you go from $7 to $15 in a very short period of time, potentially that could have a negative effect on some economies because that is a very big jump. And you're saying to businesses that employ a large number of minimum wage workers, your payroll is basically going to double. That could have a negative impact. It would have to be studied.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

The world is likely to view any temporary extension of the income tax cuts for the top two percent as a prelude to a long-term or permanent extension, and that would hurt economic recovery as well by undermining confidence that we're prepared to make a commitment today to bring down our future deficits.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.