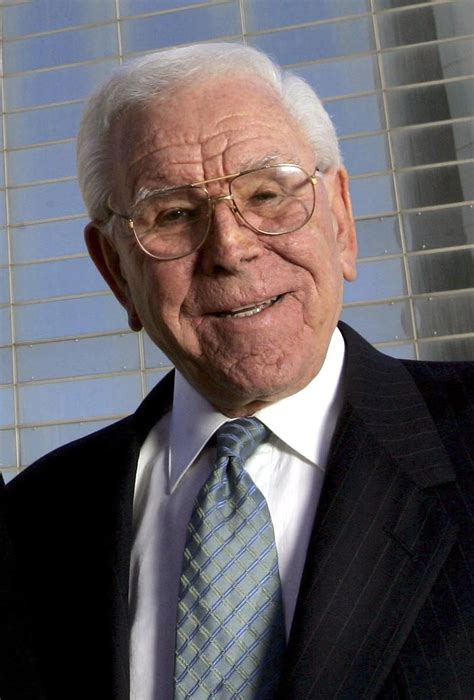

A Quote by Mark Zandi

The key to house prices is the share of foreclosure or short sales in the total housing market. When that share rises, house prices will fall, because distressed properties sell for significantly less - currently around 25 percent below non-distressed houses.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

There is plenty of blame to go around for the U.S. housing bubble, but not much of it belongs to Fannie Mae and Freddie Mac. The two giant housing-finance institutions made many mistakes over the decades, some of them real whoppers, but causing house prices to soar and then crater during the past decade weren't among them.

In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be. The thing to do is to watch the market, read the tape to determine the limits of the get nowhere prices, and make up your mind that you will not take an interest until the prices breaks through the limit in either direction.

The problem is, to have prices fall would work fine if we didn't have all these built in rigidities on downward prices, because then things don't adjust, and that's how we have recessions and depressions, is prices and costs don't adjust together and they get out of whack, and we end up with dislocations.