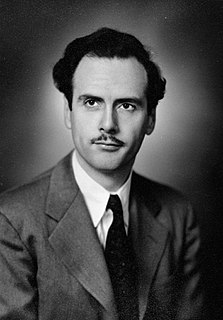

A Quote by Marshall McLuhan

Related Quotes

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

There's also consumer debt, the credit card debt that burdens many of the working families in America. Yes, we talk about national debt, and we're paying a lot down. But you're fixing to hear me tell you part of the remedy for people who have got a lot of credit card debt is to make sure people get some of their own money back.

Under the old system - which is now so archaic that a lot of people can't remember it - if you wanted money you had to go to the bank and take the money out in cash form, and you couldn't take out money that you didn't have. But with the credit card you can spend money you don't have, and that is just so tempting.