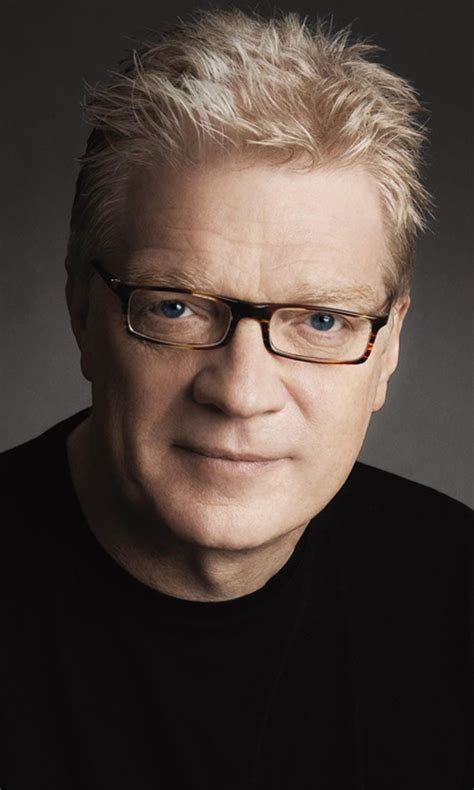

A Quote by Martin Naughton

I don't think I'd enjoy running a public company. We haven't needed to go to the market to fund expansion.

Related Quotes

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.

Experience conclusively shows that index-fund buyers are likely to obtain results exceeding those of the typical fund manager, whose large advisory fees and substantial portfolio turnover tend to reduce investment yields. Many people will find the guarantee of playing the stock-market game at par every round a very attractive one. The index fund is a sensible, serviceable method for obtaining the market's rate of return with absolutely no effort and minimal expense.

The reason to go public is that it is a massive branding, marketing, credibility, trust-building exercise with your customers, and then it allows you to consolidate power and scale and market share. Do we want to be a huge company with a huge impact? If the answer to that is yes, the only way that that happens is by going public. It is effectively a branding event that catalyzes interest. It helps with recruiting, it helps with marketing, it helps with sales. It just helps on many dimensions. I think it's basically a litmus test for the CEO's ambition.

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.

Every politician just has to remember how he got his position in the first place. A young candidate running for Congress or any outsider interested in public office could only achieve his goals by relying on soft power. They could not force anyone to vote for them. They needed to convince their potential voters, they needed to do fundraising, they needed to be attractive candidates.