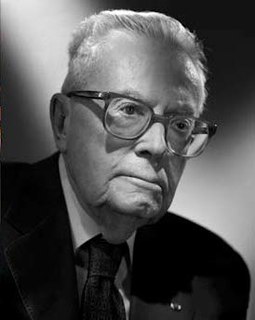

A Quote by Martin Zweig

Monetary conditions exert an enormous influence on stock prices. Indeed, the monetary climate - primarily the trend in interest rates and Federal Reserve policy - is the dominant factor in determining the stock market's major direction.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.