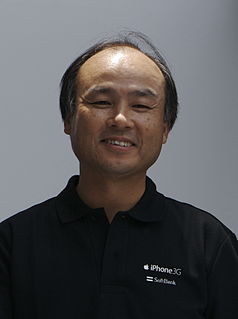

A Quote by Masayoshi Son

Money is available from investors as long as you have a great business model and a talented leader.

Related Quotes

The old model of the industry was founded largely upon business folk trying to make money off artists. At EMP, we let the music make the money, not the other way around. We have flipped the model to make the artistry be at the forefront of everything we do. Music makes the business and that's what makes it work.

Investors do not like losing money. They do not like companies that fail. They do not like entrepreneurs that fail. There is not a culture of celebrating failure in Silicon Valley or anyplace else. That is a myth. Recognize this, and if you start another business, get it to a successful point before approaching outside investors again.

Every human being needs to know to be a great parent, for a teacher to be a great teacher, and for a business partner to be a great business partner. We can't fall back on, "Oh, I only said it once and it didn't matter." That kind of phrase. That's a not-good thing for a leader to hold inside. If what that leader did is do that separation and this person now knew that they were not going to be on the popular team, doing it once and then not doing it again isn't enough to erase what just happened.

I'm never gonna owe money because every time I get a dollar, I put it into another business, whether it's to buy goods or develop other companies. You don't have money; you have companies. That's one business model. That's mine. And I only associate with other people that are putting up their own money, 'cause they're the only ones that can relate.

Sure there are some companies at the margins of our society that probably do that and I think we all have the responsibility as consumers and as investors to avoid them like the plague. If we do, they won't last very long. Doing what's right is the only possible formula for long-term - I emphasize long term - business success.

In business, integrity is just as important as in any of the great public offices... but I believe one of the first and fundamental obligations of competent business leadership is above all to protect the reputation and integrity of the business - to that degree the integrity of the business is the integrity of the leader.

I still believe that for good business analysts a concentrated portfolio is a good strategy combined with a long term horizon. Once again, the secret to success in following the formula strategy is patience, a quality in short supply for both professionals and individual investors alike. I think investors should have a large portion of their assets in equities over time.