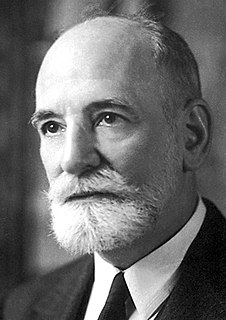

A Quote by Matt Blunt

If you're opposed to the budget I submitted to the General Assembly, you're for a tax increase.

Related Quotes

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

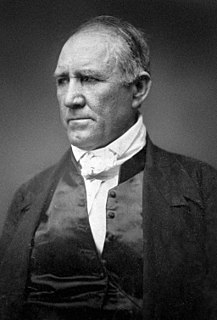

I have ever been opposed to banks, - opposed to internal improvements by the general government, - opposed to distribution of public lands among the states, - opposed to taking the power from the hands of the people, - opposed to special monopolies, - opposed to a protective tariff, - opposed to a latitudinal construction of the constitution, - opposed to slavery agitation and disunion. This is my democracy. Point to a single act of my public career not in keeping with these principles.

A World Parliamentary Assembly functioning outside the United Nations, or a United Nations Parliamentary Assembly set up as a subsidiary body of the General Assembly pursuant to article 22 of the UN Charter, could start initially as a consultative body and gradually develop into a legislative assembly.

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate revenues and a restricted economy; or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve -- and I believe this can be done -- a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.

I have often said that we have two UNs; the UN that is a Secretariat, that implements the mandates handed over to it by the General Assembly and the Security Council, and the UN that is the member states who sit in the Council, take the decisions, hand over the mandates, or take decisions in the General Assembly.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.