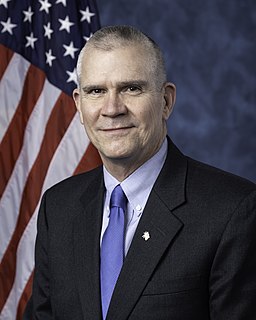

A Quote by Matt Rosendale

I advised the insurance companies to apply certain rate adjustments only to plans where the federal government provides assistance in order to save Montanans money and keep rates lower on other plans.

Related Quotes

I've laid out my economic plans. I want to grow the economy. That's why I have plans for jobs and raising incomes. I do want to go after bad actors on and off Wall Street, because I think companies that take money from federal, state, and local governments and then pick up and move should have to pay that back.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

The only way people can repay the debt is by cutting their living standards very drastically. It means agreeing to shift their pension plans from defined benefit plans - when you know what you're going to get - into just "defined contribution plans," where you put money in, like into a roach motel, and you don't know what's coming out.

There's a tradeoff. Yeah, I lose the deduction that I really like, but my tax rate is going to go down, and I don't have to fill out that form anymore. It's much simpler, rates are lower, and that tradeoff has worked in many countries. Many countries have just cleaned house of all those exemptions in order to provide lower rates, and people buy it.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.