A Quote by Matt Taibbi

What the mortgage bubble was all about was big banks like Goldman Sachs taking big bundles of subprime mortgages that were lent out largely to low-income, highly risky borrowers, and applying this kind of magic-pixie-dust math to these bundles of securities and slapping AAA ratings on them.

Related Quotes

No one pushed harder than Congressman Barney Frank to force banks and other financial institutions to reduce their mortgage lending standards, in order to meet government-set goals for more home ownership. Those lower mortgage lending standards are at the heart of the increased riskiness of the mortgage market and of the collapse of Wall Street securities based on those risky mortgages.

The financial collapse of 2008 got its start with predatory mortgages, that weren’t sold by community banks and credit unions, they were sold by fly by night mortgage brokers who had almost zero federal oversight and then the big banks looked over, saw the profit potential and they wanted it bad. So they jumped in and sold millions of these terrible mortgages while the bank regulators just looked the other way.

I had begun to worry about the housing market back in 2003, when lenders first resurrected interest-only mortgages, loosening their credit standards to generate a greater volume of loans. Throughout 2004, I had watched as these mortgages were offered to more and more subprime borrowers - those with the weakest credit.

Goldman Sachs was fundamentally responsible for the crash of 2008, but by that time its former Chairman and Chief Executive Officer, Henry 'Hank' Paulson, had been installed as US Treasury Secretary to begin the bank bail out policy, with enormous benefit to Goldman Sachs, in the closing weeks of the Bush administration. Goldman Sachs was also instrumental in the collapse of the economy in Greece that started the 'euro panic' that later engulfed Ireland.

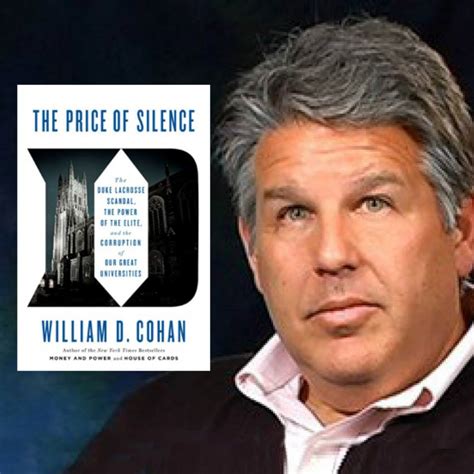

Because I wrote a book about Goldman Sachs. And I know that, from talking to people at Goldman Sachs, that Trump is the poster child for the kind of client they don't want to do business with, mainly because he would borrow all this money from Wall Street to build his casinos, and then didn't pay it back.

In early 2005, I really studied the prospectuses of these mortgage pools that were tranched out into different-rated slices rated by agencies like S&P and Moody's. They had names like Park Place and People's Choice. It was clear to me that many of the buyers of these repackaged subprime mortgages were doing little analysis.

Securities based on risky mortgages are what toppled financial institutions but it was the government that made the mortgages risky in the first place, by making home-ownership statistics the holy grail, for which everything else was to be sacrificed, including commonsense standards for making home loans.

We survived for hundreds of years under the old banking structure. You'd have clearing banks, then merchant banks doing the racy stuff, and then building societies where you'd join a waiting list for a mortgage. But then banks started buying stockbrokers, doing mortgages, and you ended up with these big banking groups doing everything.