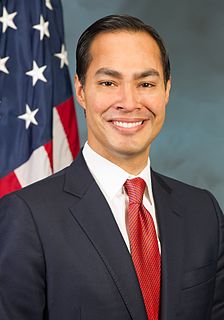

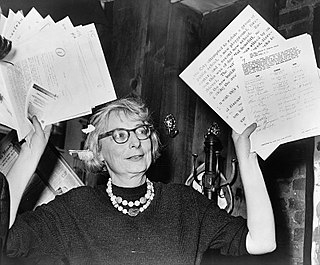

A Quote by Matthew Desmond

There is a reason so many Americans choose to develop their net worth through homeownership: It is a proven wealth builder and savings compeller.

Related Quotes

One might ask the question: Is the mortgage interest deduction doing a better job, a worse job, if it's supposed to promote homeownership and savings? Because home ownership is the biggest form of savings in this country. Different people will look at that data and draw different conclusions, but that's just an example of the kind of thing you can pull out of USAFacts and develop a point of view about.

The average net worth of the lower half of the distribution, representing 62 million households, was $11,000 in 2013. About one-fourth of these families reported zero wealth or negative net worth, and a significant fraction of those said they were "underwater" on their home mortgages, owing more than the value of the home. This $11,000 average is 50 percent lower than the average wealth of the lower half of families in 1989, adjusted for inflation.

Not yet have I found any better method to prosper during the future financial chaos, which is likely to last many years, than to keep your net worth in shares of those corporations that have proven to have the widest profit margins and the most rapidly increasing profits. Earning power is likely to continue to be valuable, especially if diversified among many nations.

The distribution of wealth is even more unequal than that of income. ...The wealthiest 5% of American households held 54% of all wealth reported in the 1989 survey. Their share rose to 61% in 2010 and reached 63% in 2013. By contrast, the rest of those in the top half of the wealth distribution ?families that in 2013 had a net worth between $81,000 and $1.9 million ?held 43% of wealth in 1989 and only 36% in 2013.

During the last two years the wealthiest 14 Americans saw their wealth increase by $157 billion. This is truly unbelievable. This $157 billion INCREASE in wealth among 14 individuals is more wealth that is owned, collectively, by 130 million Americans. This country does not survive morally, economically or politically when so few have so much, and so many have so little.

I think Americans have every reason to be worried about ISIS and the network of terrorist groups, because they have proven to be sophisticated and effective in wreaking violence and murder in many parts of the world, including in San Bernardino with their somehow connected radicalization of that couple there.

In 1985, the top five percent of the households - the wealthiest five percent - had net worth of $8 trillion - which is a lot. Today, after serial bubble after serial bubble, the top five per cent have net worth of $40 trillion. The top five percent have gained more wealth than the whole human race had created prior to 1980.