A Quote by Max Boot

I am certain that my family - my grandmother, mother and myself - had a credit score of zero when we arrived in 1976. There were no credit cards in the Soviet Union, and we didn't have any money.

Related Quotes

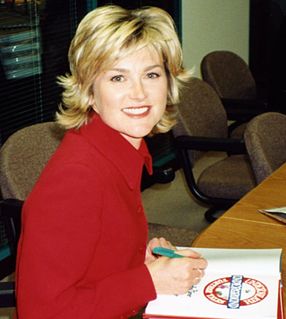

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

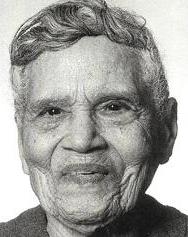

The world is a puzzling place today. All these banks sending us credit cards, with our names on them. Well, we didn't order any credit cards! We don't spend what we don't have. So we just cut them in half and throw them out, just as soon as we open them in the mail. Imagine a bank sending credit cards to two ladies over a hundred years old! What are those folks thinking?

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.