A Quote by Megan McArdle

If we wanted a program to help the majority of the population, we'd offer loan guarantees to help poor people get access to reliable cars so that they could have a better shot at getting - and keeping - a well-paying job...A small amount of capital could make a much bigger difference in their lives than extra student loan relief for middle-class college kids would.

Quote Topics

Related Quotes

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

If you wanted to create jobs in a way that has minimal effect on the deficit but has government action, the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that.

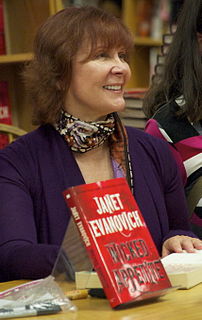

That’s nice of you, but it’s not necessary to loan me a car.” “I loan you cars all the time.” “And I almost always destroy them or lose them. I have terrible luck with cars.” “Working at Rangeman is a high-stress job, and you’re one of our few sources of comic relief. I give you a car and my men start a pool on how long it will take you to trash it. You’re a line item in my budget under entertainment.

Student loan debt is crushing young people. And so they're not doing the things we would expect them to do. They're not moving out of their parents' homes in as big a numbers, they're not saving up money for down payments, they're not buying homes or cars or starting small businesses or doing any of the things that help move this economy forward.

People just want to see something happen that is positive for them in their lives. If you're struggling to pay your student-loan debts, or if you've got a kid trying to go to college and don't think you're going to be able to afford it, it really matters whether you get help or not. If you don't have health care or you have insurance but the insurance company won't pay for what your doctor says you need, then what's the point of people arguing in Washington? Why don't you give me some help to fix this problem? I will work with anybody if I think we can actually produce results for people.