A Quote by Mellody Hobson

I'd like to see great textbooks, great opportunities for kids to really understand stock market investing, because at the end of the day, they are going to be all they have in terms of creating a life for themselves, a retirement account, and things like that.

Related Quotes

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

In terms of my profession, I'm passionate about financial literacy. I want to live in a financially literate society. I want kids to understand the importance of savings and investing. I want to try to replicate the great savers who came out of the Depression, the best savers the country has ever seen. It's crucial that people understand the importance of financial literacy, because it's actually life saving.

Tech stocks were the cubic zirconium of the market. They looked good and were sexy, but they just were a way for the company selling them to make money. That's always going to be transient in terms of the stock market. What's real is that companies have to compete. Technology used well is a great tool to enable that if only because most companies dont use technologies well.

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity,' sing the praises of companies with high share turnover... but investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pick pocket of enterprise.

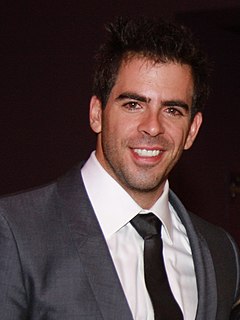

I like movies that work on two levels - like The Simpsons, kids can watch it and adults can watch it. Teenagers can watch Hostel and if they want to see a blood and guts violent movie they're going to have a great time. They're going to scream and yell, it's a great date movie because they're going to squeeze their date and their date is probably going to be too scared to go home... so you take them home and put on Dirty Dancing and everybody wins.