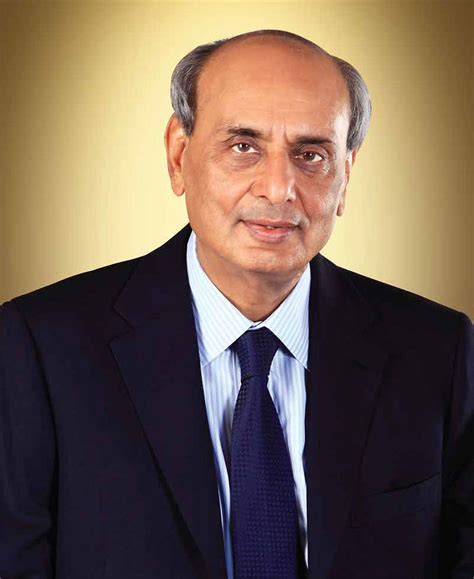

A Quote by Mian Muhammad Mansha

Banks need to have large shareholders on the board that have a direct interest in their performance.

Quote Topics

Related Quotes

You know policy is driven purely in self interest. The Federal Reserve Bank and the commercial banks and the Wall Street banks are not acting in the interests of the population at large, they're acting purely in their own self-interest, which is a shame because they're actions dictate the reality for 300 million Americans. But they don't see it that way, they see it only as a way to preserve their own self-interest.

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.