A Quote by Michael Bloomberg

The estate taxes, on balance, are good. They get people to give money to charity, and they prevent these family dynasties which keep other people from having opportunities. It may be good for a family, but for society it's probably not good. And I've always been in favor of having an estate tax.

Related Quotes

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.

I am an optimist, and I believe that people are inherently good and that if you give everyone a voice and freedom of expression, the truth and the good will outweigh the bad. So, on the whole, I think the power that online distribution confers is a positive thing for society. Online we can act as a fifth estate.

Once money goes into a charity, it is tax exempt, so that's a benefit you get. And in return, you have to use the assets of the charity to serve the public good. So if Trump is using this money basically to save his businesses, the money isn't helping people. That's a violation of the letter and the spirit of law.

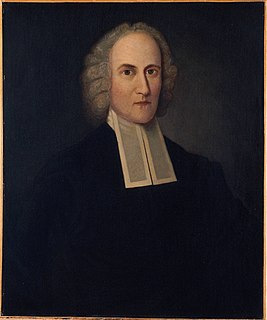

All the fruits of the Spirit which we are to lay weight upon as evidential of grace, are summed up in charity, or Christian love; because this is the sum of all grace. And the only way, therefore, in which any can know their good estate, is by discerning the exercises of this divine charity in their hearts; for without charity, let men have what gifts you please, they are nothing.

Churches are tax exempt because they are supposed to provide a public good. To prove that good to the IRS, churches arent supposed to hoard their money. They are supposed to spend it on goods and services for the faithful. Under this pretense, the church has made massive investments in tax free real estate all over the world. And when it comes to labor costs, they are almost free.

Whichever work you do, people go through life having several priorities. I know my football is what got me here. The work I do for SOS or my charity work in general has always been a priority for me, and then my family is a priority as well, so you set yourself different things, and they just balance each other out.

The universe defies you to answer the following questions: What good is a high paying career if it leaves you continually stressed out and miserable? What good is owning a large stately house if the only time you spend in it is when you sleep in it? What good is having a lot of interesting possessions if you never have the free time to enjoy them? Above all, what good is having a family if you seldom see any of its members?

Your generosity is reflected in what you do with your own money, not in what you do with other people's money. If I give a lot of money to charity, then I am generous. If you give a smaller fraction of your money to charity, then you are less generous. But if you want to tax me in order to give my money to charity, that does not make you generous.

The family of Dashwood had long been settled in Sussex. Their estate was large, and their residence was at Norland Park, in the centre of their property, where, for many generations, they had lived in so respectable a manner as to engage the general good opinion of their surrounding acquaintance. The late owner of this estate was a single man, who lived to a very advanced age, and who for many years of his life, had a constant companion and housekeeper in his sister.